News Digest (www.upstreamonline.com)

Satellite data reveals that Venezuela's oil and gas sector is a significant source of methane emissions, presenting a major invisible hurdle to rebuilding its upstream industry. Analysis from Kayrros identified 45 super-emitter facilities, primarily due to malfunctioning flare stacks and open-air waste pits. These emissions have placed Venezuela as the sixth-highest globally for observed methane plumes and the seventh-largest oil and gas methane emitter worldwide, according to the International Energy Agency.

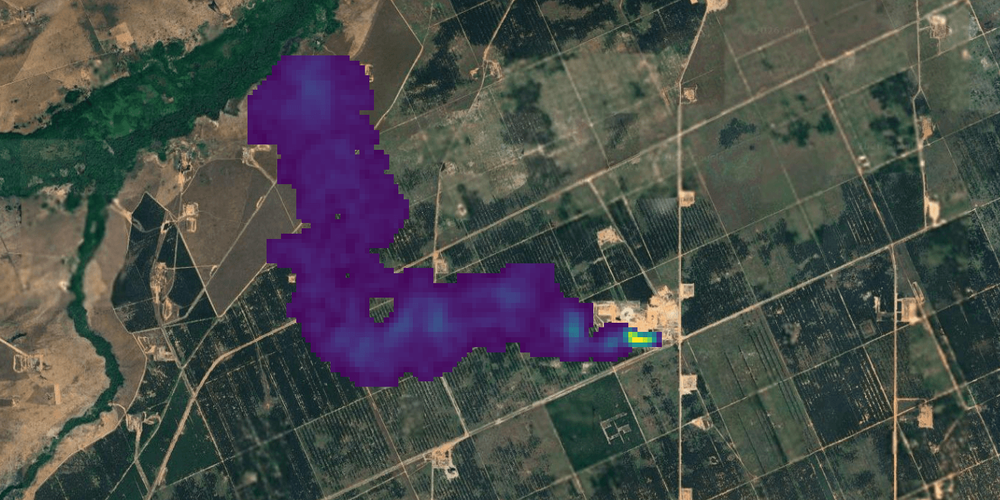

Scale and Sources of Emissions

The largest detected plume, from a Bitumenes Orinoco facility in the Orinoco Belt, released 7.74 tonnes of methane per hour. On average, the super-emitters released 4.8 tonnes per hour, originating from fields in the Eastern basin such as Santa Rosa and Nipa. Venezuela is the only major Latin American oil producer not to have joined the Global Methane Pledge, underscoring a lack of action on reducing these greenhouse gas emissions.

Feasibility of Solutions and Industry Context

Analysts note the emissions are largely fixable with better waste management, leak detection, and repair practices, with the IEA estimating 70% of global fossil fuel methane emissions could be avoided with existing technology. Remote sensing via satellites is highlighted as a game-changer for assessing infrastructure. While global majors have committed to zero routine flaring by 2030, calls have been made for this principle to be central to Venezuela's industry reboot.

Broader Infrastructure and Investment Challenges

Beyond methane, revitalizing production faces enormous costs from aging and damaged infrastructure. Estimates to restore peak production of around 3.4 million barrels per day range from $65 billion to $100 billion. Key regional challenges include:

- Orinoco Belt: Prioritized for investment due to large volumes and relatively less damaged infrastructure, but requires multi-billion dollar investments to reactivate upgraders.

- Maracaibo region: Faces severe corrosion in its extensive subsea pipeline network due to increased lake salinity, leading to leaks and abandonment.

- Eastern Venezuela: Where flaring is acute, investment would focus on restoring gas reinjection capacity.

Specific projects like Petromonagas (formerly ExxonMobil's Cerro Negro) are in better condition than others, such as Petrolera Roraima (formerly ConocoPhillips' Petrozuata), which has seen an 80% production decline and would require major capital for restoration.

Current Operational Status

Following a recent US blockade, crude exports halted, leading to full storage facilities. Onshore crude stocks were around 25 million barrels, below pandemic highs. Some storage tanks have been dismantled, and idled tanks are likely corroding quickly without maintenance, further reducing available infrastructure capacity.

22 January 2026

This material is an AI-assisted summary based on publicly available sources and may contain inaccuracies. For the original and full details, please refer to the source link. Based on materials by Rebecca Conan. All rights to the original text and images remain with their respective rights holders.